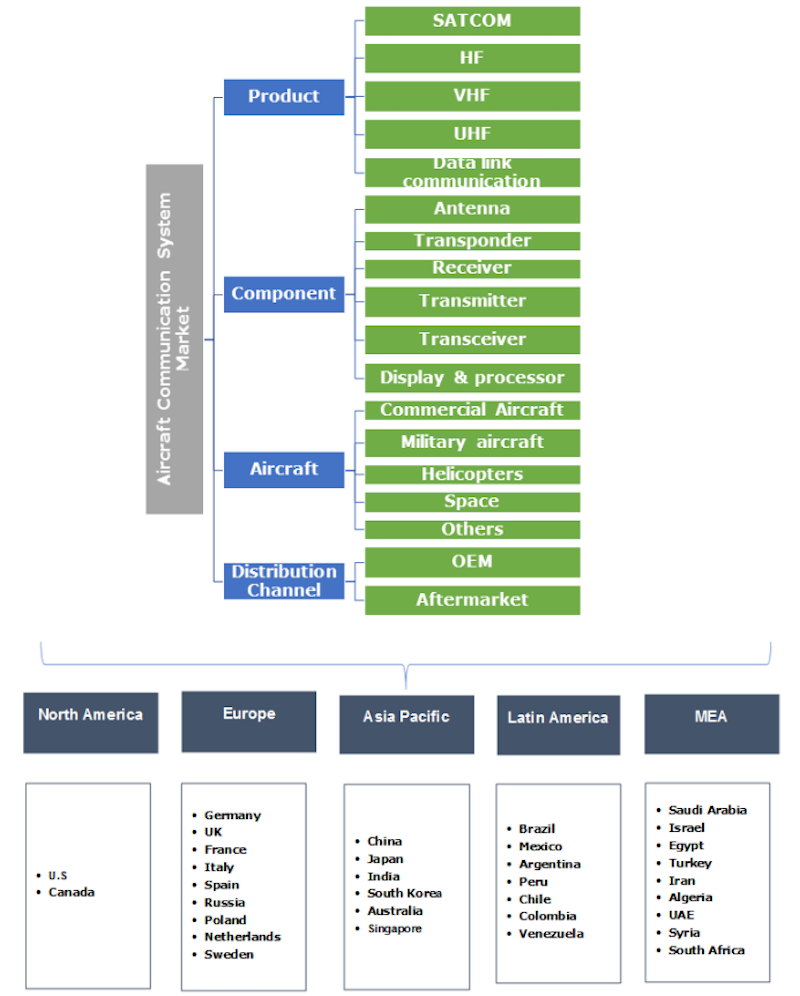

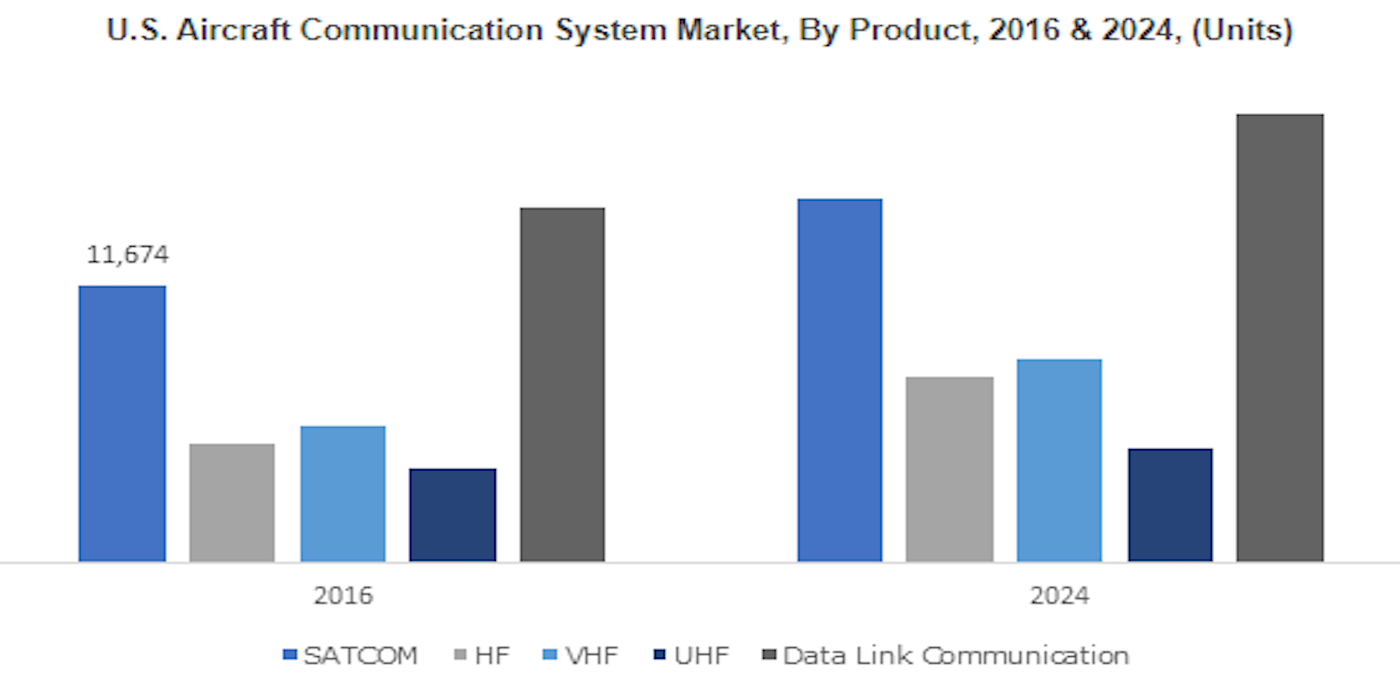

Rising demand for next-generation communications technologies in aircraft, along with expansion in the defense sector across the globe, is expected to drive the aircraft communication system market over the 2016-2024 timeframe. SATCOM is set to dominate the aircraft communication system market over the next eight years, capturing over 35% of the volume share owing to the provision of benefits such as efficiency in air traffic management and superior communication. Moreover, its extensive usage in military aircraft will strengthen product penetration due to increasing orders. This high demand from the military aircraft sector is due to rising defense budgets across the globe, which will further support market growth in the aircraft communication systems sector.

HF communication systems will exhibit at over 7.5% CAGR from 2017 to 2024 owing to regular innovation updates in the product, coupled with the provision of efficient communication over long distance routes. Indeed the aircraft communication system market will exceed US$1.3 billion by 2024, according to a new research report by Global Market Insights, Inc.

OEMs will account for over 90% of the revenue share in the aircraft communication system market owing to the high deployment of these systems for safety, maintenance and air traffic control. Moreover, competitors are entering into long-term supply agreements with OEMs, providing further stable growth prospects. A shifting trend towards the replacement of components including transceivers, transmitters, etc will primarily drive the growth of aftermarket segment. Frequent enhancements in these communication systems is another factor responsible for the substantial aircraft communication system market growth over the coming years.

Increasing implementation of advanced technologies coupled with the growing aviation industry will primarily drive the aircraft communication system market size. Multiple developing countries in the world are witnessing an increase in air passenger traffic owing to affordable prices. This has resulted in a substantial rise in aircraft deliveries from various manufacturers, further propelling the industry growth over the next eight years.

Transponders will account for more than US$640 million in the aircraft communication system market by the end of 2024. High revenue generation can be attributed to the provision of precise information about the aircraft such as aircraft identification and barometric altitude. Moreover, advantages such as maintaining proper communication with on-ground ATC systems has led to its wide implementation in military and commercial aircrafts.

The increasing defense budgets of multiple countries is another factor positively impacting growth in the aircraft communication systems market. For instance, the US defense budget exceeded US$604 billion in 2016 and is expected to further increase in 2018. This has led to the increased production of military aircraft, escalating revenue generation. The high profit margin of the industry players is due to the rising number of orders for helicopters and military aircraft, which will result in the increased deployment of these advanced communication systems, which in turn will further strengthen market penetration of aircraft communication systems. However, signal congestion, specifically for low frequency bands, may pose a challenge.

Military aircraft will account for the greatest proportion of the aircraft communication systems market, accounting for over 64,000 units until 2024, owing to the rising implementation of SATCOM and other advanced technologies in these aircraft. Increasing demand for fighter jets with multi-functional capabilities such as ground and air attack systems will further support its dominance. Commercial aircraft will account for a more than 3.5% CAGR owing to the growing aviation sector across the globe. Rising air passenger traffic has resulted in increased demand for these communication systems, ensuring passenger safety, and creating further positive impact for the aircraft communication system market.

Manufacturers, particularly those from developed regions including North America and Europe, are focusing on growth opportunities from the international markets. Moreover, they are developing long-term contracts with OEMs, creating immense potential for the size of the aircraft communication systems market. Weight reductions in the overall system, along with versatility for multiple usage, is the primary focus of the industry participants. The shifting trend towards replacing the conventional communication systems with advanced counterparts has also gained prominence.

The North American aircraft communication systems market is expected to account for over 35% of the revenue share over the forecast timeframe. This can be credited to the presence of established aerospace industry leaders, as well as the rising deployment of advanced communication systems in prominent across the region. Rising defense expenditure of developed countries, including the US, will further contribute towards the region’s dominance. The Asia Pacific aircraft communication systems market will grow rapidly, exhibiting a CAGR of over 6% over the coming years. The increase in aircraft deliveries has led to high demand for these systems, primarily supporting the regional growth.

L3 Technologies, Harris Corporation, Thales, Cobham Plc, Lockheed Martin, and Raytheon are among the major players in the aircraft communication systems market . Other prominent participants in this market include Viasat, General Dynamics, Honeywell Aerospace, Northrop Grumman Corporation and UTC Aerospace Systems. Industry participants are adopting mergers and acquisitions as their prominent strategy to strengthen their foothold in the sector. For example, in May 2014 Cobham completed the acquisition of Aeroflex, a manufacturer of communication systems, to expand its product portfolio and enhance its visibility.