Since the air shows restarted post-Covid back in 2022, the key factor dominating them has been the supply chain. While that factor is far from going away anytime soon, threats of protectionism have bumped it off the top spot once again.

Let’s be clear, it has always been there, but rarely has it been such a widespread issue as it is today. We shouldn’t be too surprised, as 2024 was an election super-cycle, but trade was opening, supply chains were slowly getting back on track, unemployment was low, and central bankers had assumed they had dodged the recession bullet.

Whether the motivation is purely a veiled tactic to get the US tax cut extension passed or part of a larger crusade, the near-term outcome remains the same – the market is nervous, and uncertainty creeps in.

The landscape in 2025 so far

Back in January, in our Market Outlook webinar, IBA highlighted this anticipated tension, but remained bullish on long-term trade due to the overarching force of US consumption, meaning trade deals would be achievable. Our view on this largely remains the same, albeit that relations between China and the US may take longer to repair.

But if we assume that agreements are not reached, then it does of course become a different story. Inflation will stifle growth, compounded by fiscal tightening, but we don’t want to go there as it’s second-guessing which barrel the bullet is in.

Despite the uncertainty and threat of dwindling traffic, US consumer confidence appeared to rebound in May, largely off the back of cooling tensions and job security. Non-essential expenses may hurt ticket sales, but in the years since the Covid pandemic, rising inflation has done little to stifle growth in global air travel demand.

Stepping back though, aircraft orders have very little to do with near-term demand when the likely first delivery slots could be eight years away. However, near-term uncertainty, rising costs and slipping yields may well underscore a greater desire to place non-firm commitments instead.

Similarly, the skyline may require some near-term shuffling too. Some articles have sensationalised the situation by highlighting the potential for cancellations, but that is speculation at this juncture. Due to the time between orders and delivery, any cancellations that do occur in the near-term would have occurred anyway.

Given all the gloomy speculation, it would be good to see a positive Paris Air Show. Deals are not struck at air shows, but they are the place where you go to make a splash. In that case, it will serve as a good barometer. The Middle East tour by President Trump certainly highlighted the fact that order announcements may not appear far-fetched after all, so I will also remain optimistic.

Anticipated activity at the Paris Air Show

Middle East

The Middle East saw most of its order activity in May (for Boeing), and I fully expect the second act to appear during Paris week for Airbus. But is it all getting a bit much? Looking at data from our IBA Insight platform, the region currently supports around 1,569 active and short-term parked passenger and freight aircraft, with another 1,732 aircraft on firm order, plus around 335 commitments to buy (depending on how Boeing account for some of the recent additions).

That equates to around 375,000 seats in the current system, with a further 425,000 seats on firm backlog. With an average age of 13 years (active and parked), the backlog would allow for replacement and marginal growth, but not to the level envisaged by the key players from the UAE and Saudi Arabia. Assuming global traffic continues to double every 15 years, huge orders remain on the cards.

In terms of where orders may come from in Paris, likely airlines are Riyadh Air (A350s), Qatar Airways (A320 family and possibly some more A350s) and Etihad Airways (A350s to match the B787s they ordered in May). While I expect Emirates to decide this year on its next widebody order, I feel they will wait for the Dubai Air Show in November.

India

I don’t think it would be a post-Covid air show without some orders coming from India. So far, the backlog has reached 1,757 firm and 150 options – staggering when you consider that 82% of that figure comes from IndiGo and Air India. They may have the narrowbodies covered well, but I sense the battle for the long-range market still has legs in it. Possibly some more A350s and B777s for both big carriers.

Asia Pacific

The rest of APAC could certainly provide a boost to the Paris order book. However, identifying operators that will choose to act becomes more challenging. It is certainly the case that mainland Chinese operators have fallen back on growth in recent years, albeit their orders are often cloaked behind the undisclosed banner.

Certain tensions would also preclude any chance of APAC airlines placing a central order for Boeing at short notice, but an outside chance to upset the negotiations by going with the home team would send a message. I don’t think so, somehow.

Elsewhere, Philippine Airlines, PIA (Pakistan), JAL (Japan), Cathay Pacific, and many others may look to Paris to announce orders across narrow-body, wide-body, regional and turboprop sectors. Possibly something from COMAC, too, maybe as a statement of solidarity.

The Americas

The bulk of uncertainty may centre on the Americas right now, but that may catalyse a near-term decision on long-term fleet plans, especially as that region shifts between the low-cost and premium offerings.

There is a lot to replace in this space, and outside of some sizeable backlogs, much of the backlog is insufficient to cover replacement, let alone growth. For example, American Airlines may have a steady backlog of narrowbodies and Boeing 787s, but it’s still short of what’s required. Delta Air Lines is in a similar position. That being said, neither operator tends to use an air show to announce fleet decisions, except for a sizeable number of E-Jets and B737 MAX-9/10s.

Europe

Again, lots of opportunity for additional orders to be placed, but it is challenging to pick out any clear targets. IAG already placed a sizeable order in May to cover some replacement and growth for long-haul operations for British Airways, Iberia, Aer Lingus and Level, but there are still gaps for further narrowbody replacements.

Probably more prominently, Air France needs to consider narrowbody replacements to join its A220s. Data from IBA Insight, the aviation intelligence platform, shows the average age of the airline’s A320 ceo fleet is now 18 years old, with the oldest close to 31 years. The average age of its B777s and A330s is even higher, with 50% over 20 years old. KLM is only marginally better. Elsewhere, Ryanair has intimated that it could firm up its Boeing 737 MAX 10 order.

Africa

Whilst not significant in relative demand terms against other regions, opportunities remain for replacement and growth orders, especially across North Africa.

EgyptAir may have encountered significant issues with GTF-powered A220s, but the airline continues to look to expand beyond 2030. Similarly, Royal Air Maroc and Tunisair too. Royal Air Maroc in particular, will be planning big returns from the 2030 World Cup in Morocco, Spain and Portugal. The planned Hassan II Stadium in Casablanca will become the largest football stadium in the world, and worthy of Royal Air Maroc’s aim to grow to 200 aircraft from the current 59.

Lessors

The lessors are naturally more challenging to predict, as the final operator is largely unknown until close to the time of delivery. While I wouldn’t necessarily expect the top five to place any speculative orders above the 1,500 they already have, the recent Avilease / Boeing order (20 firm and 10 options) may signal a similar, forthcoming Airbus order. Aside from speculative orders though, I wouldn’t rule out announcements by any of the top 10 lessors to sale-leaseback orders that accompany orders already mentioned.

Historically, it has been rare for Air Lease Corporation (ALC) not to place some form of order. Looking back through IBA Insight, since 2010 only the last two Farnborough Air Shows (2022 and 2024) failed to yield any orders from ALC.

Regional aircraft orders

In addition to the main Airbus/Boeing draw, I would expect some activity to come from Embraer and ATR. Given the strong interest in regional aircraft leasing, it is often surprising that we don’t see more activity at these large industry events aside from product launches and small orders. Especially if away from the main announcements.

My expectation is for less than 20 orders for each regional aircraft OEM. Aside from the two main regional aircraft OEMs, we expect Deutsche Aircraft to showcase the D328eco at the show this year. With LOIs in place with two operators for nine aircraft, there is much for them to do.

Military

We can’t forget that the bulk of the money spent at air shows comes from the military sector. Military sales totalled US$105 billion last year at Farnborough, with a further US$150 billion at Paris Air Show the year before. Given the geopolitical climate and demand for NATO countries to raise their game, military sales are expected to be high this year. Indeed, France prides itself on being a large military exporter, and will be putting on a big show.

Conclusion

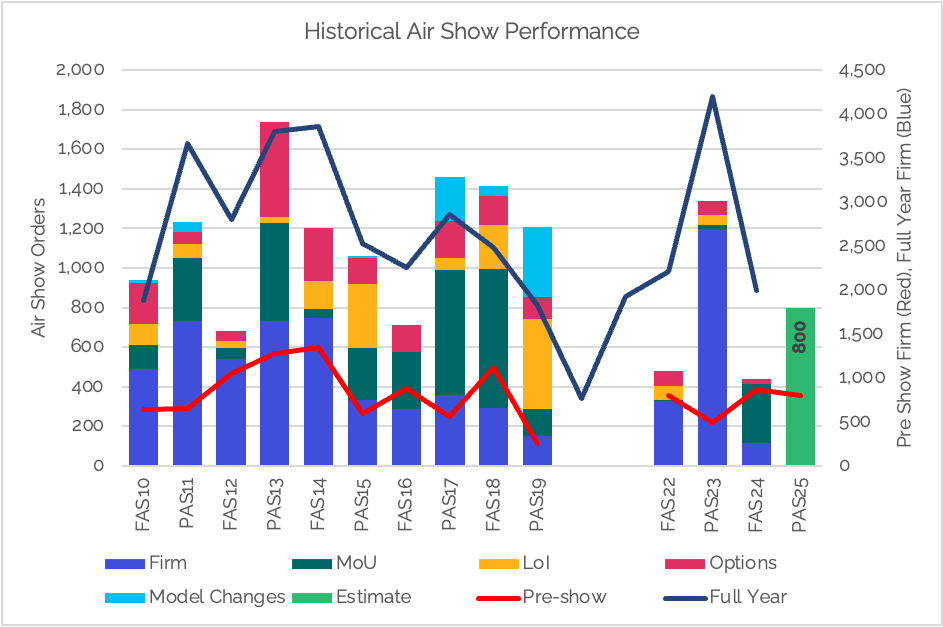

Overall, IBA predicts orders for around 700 – 800 commercial aircraft at this year’s Paris Air Show, including firm, MoU, LOI and options, but excluding model conversions and announcements not relating to a fresh order.

As with last year, IBA expects widebody aircraft to feature prominently (although the bulk will remain with the narrowbody sector) and for Airbus to gain the most orders from the show, as is normally the case on their home turf.

About IBA

All the data presented is derived from IBA Insight, the leading aviation intelligence platform. IBA delivers aviation consultancy expertise, and actionable data insights. An independent and forward-thinking business, IBA has over 35 years of heritage and experience in aviation. www.iba.aero