Demand for freighter aircraft continues to grow strongly as a result of Covid-19 travel restrictions, but values and lease rates remain suppressed by an oversupply of feedstock aircraft. Since May 2020, almost 200 narrow-body and wide-body aircraft have joined the worldwide freighter fleet.

The active fleet of narrow-body freighters has grown by 61 to 625 aircraft, with newly converted Boeing 737-800s accounting for around half that growth. The Boeing 757-200 remains the pre-eminent freighter aircraft, with a fleet of 298 aircraft (converted and factory delivered), followed by the Boeing 737-400, with 148.

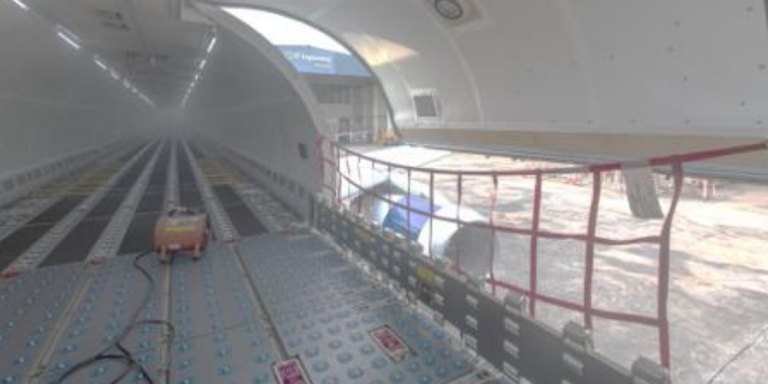

The active mid-size wide-body freighter fleet has grown more steeply in the same period by 80, to 624 aircraft. The Boeing 767-300ER is the dominant aircraft in this segment, accounting for more than half the growth as many ex-passenger aircraft and converted, with a total fleet size which now stands at 315 aircraft when one adds converted and factory delivered aircraft. The A330 freighter fleet is also growing strongly but from a much lower base, with six aircraft converted during this period, but with an additional pool of aircraft taking its fleet size to 74.

The large wide-body freighter fleet has grown by 55 to 601 aircraft since May 2020. The re-entry into service from storage of 29 Boeing 747-400s and seven MD-11Fs accounted for around half the growth, with the remainder made up of factory deliveries of 22 Boeing 777Fs and 3 747-8Fs.

Since the start of the Covid-19 pandemic, freighter aircraft usage has grown strongly, driven by the fall in belly hold capacity as passenger aircraft were grounded. The number of freighter aircraft flights, which was averaging around 100,000 per month before the pandemic, has grown, peaking at over 145,000 in December 2020 as the holiday period drove supply chain demand. Conversely, passenger aircraft utilisation fell from over 2.9 million flights in January 2020, to 556,000 in April 2020, and since then has only partially recovered to around 1.5 million flights in January 2021.

Data from IBA’s Insight.iQ platform also demonstrates the dominance of certain aircraft types in the passenger to freighter conversion market.

The Boeing 737 Classic family has now been surpassed by the Boeing 737-800 in terms of conversion rates, of which 27 were converted in 2020, and around 40 are set to be converted over the next 12 months. In the large narrow-body segment, the Boeing 757-200’s dominance of recent years continues, with 10 aircraft converted in 2020 and a further 20 set to be converted in the next 12 months. However, conversions of the A321-200 are now gathering pace, with three in 2020 and a further six in the next 12 months.

In the mid-size wide-body segment, the Boeing 767-300ER continues to dominate, with 26 aircraft set to be converted in the next 12 months, with its nearest competitor the Airbus A330-300 accounting for just seven, but with further aircraft likely to be committed for conversion.

Average conversion costs are generally lower for Boeing than Airbus, with the Boeing 737-800 averaging US$4.16 million and the Boeing 757-200 at US$5.2 million, compared to US$6.14 million for the A321-200. The average conversion cost for the Boeing 767-300ER is US$14.7 million, compared to US$18.4 million for the A330-300. Part of the reason for this cost difference is the relative size of each aircraft, with the Boeing 737 being a smaller aircraft than the A321, and the Boeing 767 being smaller than the A330.

IBA has also considered the economics of Boeing 777 freighter conversions, especially the younger, larger Boeing 777-300ER model. While conversion costs are not yet widely available, we estimate the conversion cost of a 2005-built Boeing 777-300ER to be around US$32.5 million. When also taking into account acquiring a feedstock aircraft and other associated costs, IBA estimates the total outlay for an aircraft of this age to be around US$54.5 million.

Covid-19 has significantly affected the dynamics of the freighter aircraft market, and that is set to continue for at least the next two years. However, the clear and strong growth in demand is not driving up values and lease rates as it normally would.

While the global freighter fleet is growing, as is the number of conversions, there has been a corresponding increase in aircraft available for conversion, driven by the accelerated retirement of passenger aircraft fleets. This has meant that freighter values and lease rates have actually seen a modest drop.

The value of a 2002-build Boeing 737-800 converted freighter has dropped from US$20.9 million in mid 2020, to US$18.28 million in early 2021, with younger aircraft seeing a greater drop. Lease rates for an aircraft of the same age have dropped from US$220,000 per month, to US$192,000 per month over the same period.

The value of a 2000-build Airbus A321-200 converted freighter has dropped from US$28.3 million in mid 2020, to US$23.3 million in early 2021. Lease rates for an aircraft of the same age have dropped slightly, from US$264,000 per month to US$240,000 per month over the same period.

The values of Airbus A330-300 converted freighters have seen falls of varying ranges, with older aircraft built in 1995 dropping by around 12%, whereas a 2010-built aircraft fell in value by around 25%, from US$47 million in mid 2020, to US$35.48 million in early 2021. The fall in lease rates has also increased with younger aircraft, ranging from around 8% for a 1995-built aircraft, to around 11% for a 2010 model.