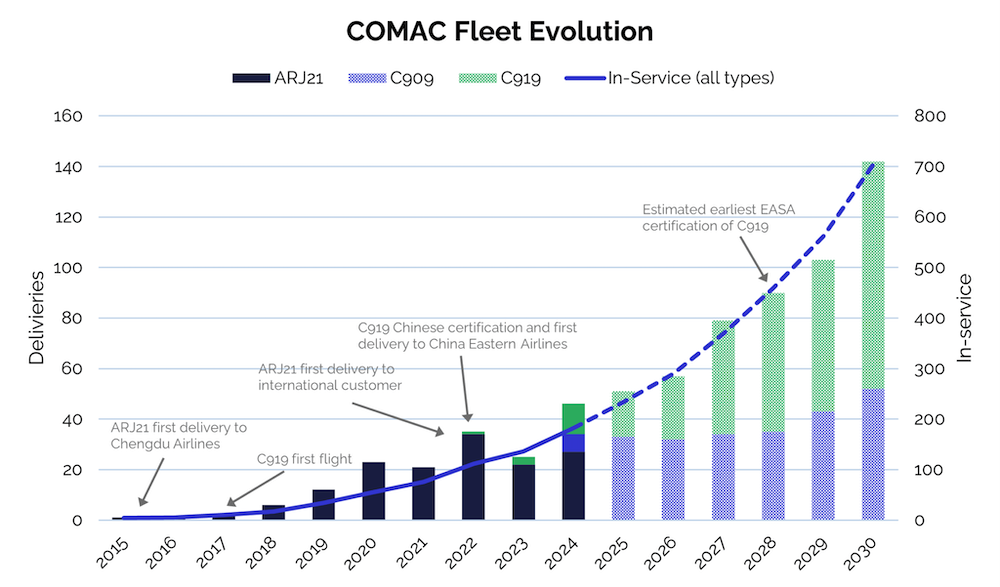

IBA, the aviation market intelligence and advisory company, forecasts that the Commercial Aircraft Corporation of China (COMAC) will more than triple its rate of aircraft deliveries to 145 per year by 2030, marking steady progress in China’s ambition to establish an independent commercial aviation industry.

COMAC is expected to deliver 50 aircraft in 2025, rising to 57 in 2026, 79 in 2027, and around 90 in 2028, before reaching 145 by the end of the decade. Deliveries will be dominated by the C919 narrowbody programme, supported by continued output of the C909 regional jet and development of the future C929 widebody.

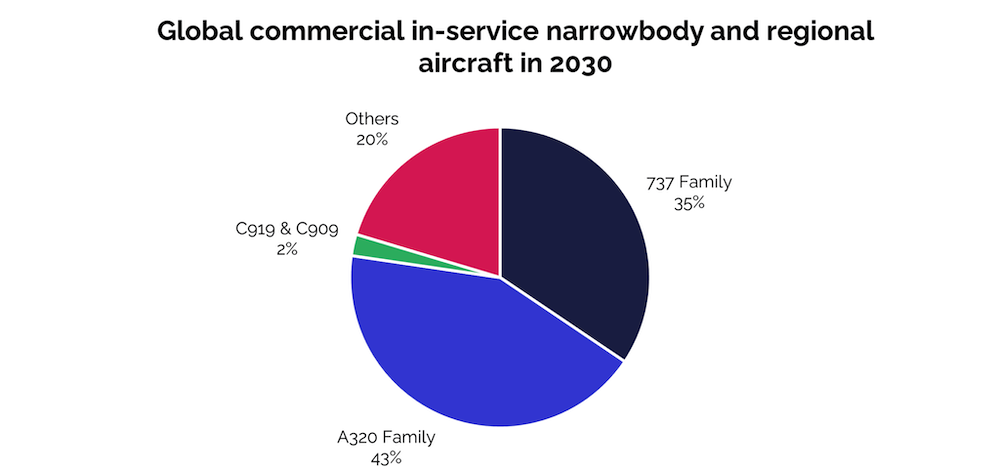

By 2030, IBA forecasts COMAC will have secured around 65% of new narrowbody deliveries to Chinese operators, although this will equate to just 7% of the total in-service fleet when legacy Airbus and Boeing types are included. Globally, the C919 and C909 will remain a niche player, at approximately 2% of the world fleet in 2030, but this is a clear start of the breaking of the Airbus and Boeing duopoly.

Despite progress, challenges remain for COMAC. The July 2025 resumption of US export licences for the CFM LEAP-1C and GE CF34-10A engines stabilised production, but reliance on imported propulsion and avionics leaves COMAC exposed to supply chain and geopolitical risks. Stockpiled components offer only short-term security, while the CJ-1000A domestic engine is still years from commercial readiness.

Certification is another hurdle as the C919, which has been in service since 2023, is unlikely to gain EASA validation before 2028, limiting sales outside China. In the meantime, COMAC is focusing on domestic operations and selective regional placements to build credibility.

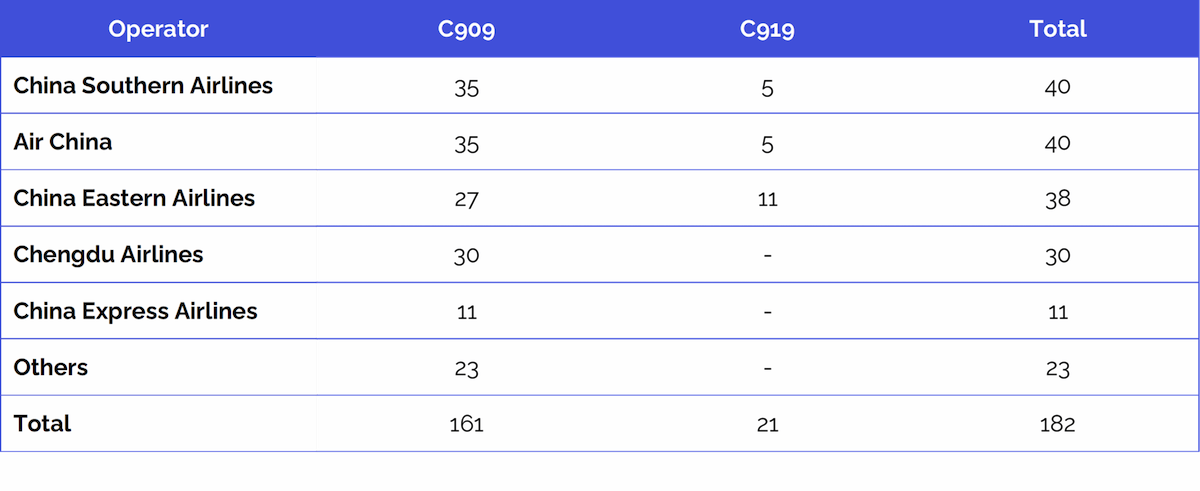

IBA Insight data shows that COMAC’s in-service fleet reached 182 aircraft by August 2025, concentrated among China Southern Airlines, Air China, and China Eastern Airlines, with smaller allocations at Chengdu Airlines, China Express, VietJet, and Lao Airlines.

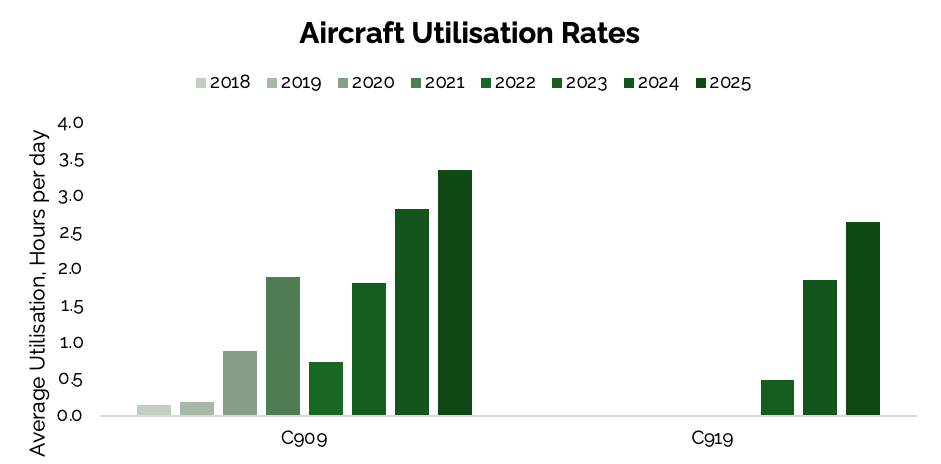

Reliability metrics are also improving, as the average daily utilisation of the C909 has risen to 3.4 hours, up from under one hour in 2018, while the C919 has reached 2.6 hours per day since entry into service. Both aircraft types remain below the narrowbody benchmark of seven hours, but are expected to climb as maintenance networks and operator confidence grows.

IBA anticipates that while COMAC will not rival the scale of Airbus or Boeing this decade, its trajectory signals the emergence of a credible multi-sector competitor. Political support, strong domestic demand, and incremental progress on international certification are positioning COMAC to play a measured, yet increasingly significant, role in global commercial aviation.

For more IBA insights on COMAC, you can access a report by Dan Taylor, head of consulting.