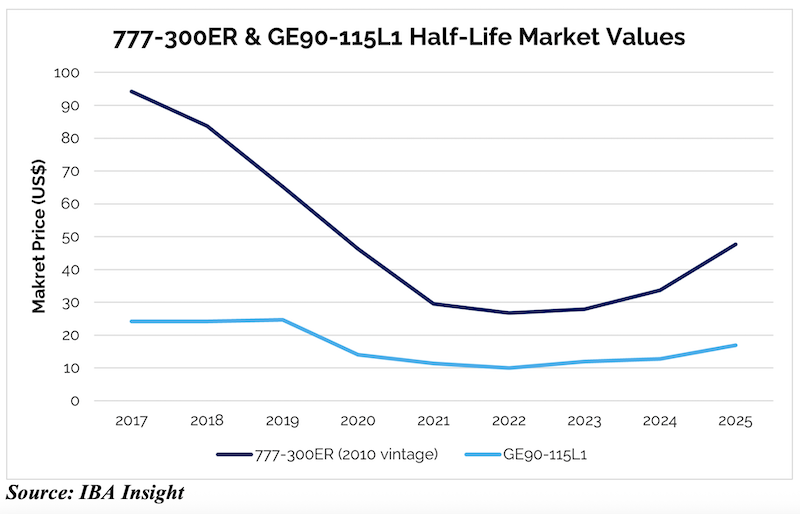

Half-life market values for the Boeing 777-300ER have jumped 78% in 2025, to about US$ 47.6 million, up from the lows of circa US$ 26.7m recorded in 2022 for a 2010 vintage.

According to the latest analysis by the IBA aviation market intelligence and advisory company, this rise in value is primarily driven by ongoing delays to Boeing’s 777X programme and limited production of Airbus’ competing A350-1000 model, which is sustaining demand for previous-generation widebody aircraft and extending the operational life of the 777-300ER fleet.

As a result, associated engine values have also strengthened. Market values for green time GE90-115B engines have risen 69%, increasing from around US$ 10m in 2022 to approximately US$ 16.9m in 2025, reflecting the increased demand for maintenance, repair, and overhaul (MRO) services as aircraft remain in service longer than originally anticipated.

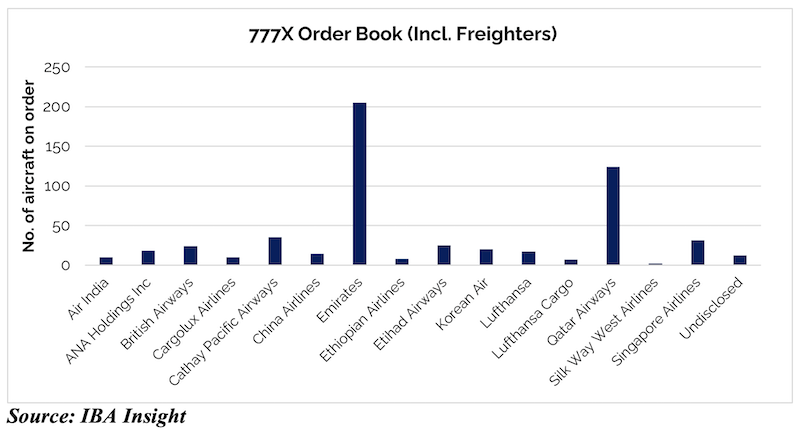

While Airbus has benefited from the continued delays in the certification of the 777X, with its A350-1000 currently the only new-generation large widebody aircraft in production, Boeing retains a strong order book for the 777X.

Intelligence from IBA indicates that Boeing currently holds 503 orders for 777X passenger aircraft, while Airbus has 103 A350-1000s in service and a further 258 on order. Once certification and deliveries of the 777X commence, IBA expects production rates to stabilise and market confidence to grow, potentially leading to additional orders.

No 777X orders have yet been placed by US carriers, likely reflecting the relatively young age of existing 777-300ER fleets at American Airlines and United Airlines, which both average under 10 years.

As these fleets mature, IBA anticipates new replacement orders may be placed, while Air Canada, operating a combined fleet of 25 Boeing 777-300ER and B777-200LR aircraft with an average age of around 16 years, could also consider the 777X as a future replacement candidate.

IBA predicts that values for previous-generation widebody aircraft will remain elevated in the short term due to constrained supply. However, with the 777X’s certification and entry into service on the horizon and OEM production rates increasing, market conditions are expected to normalise gradually.