SpaceX now has more than 5,000 aircraft under contract, with recent wins including Southwest Airlines, the Korean Air group, Lufthansa Group, IAG and Emirates. Such is the scale of change that it is easy to conclude the market is reaching maturity and that there may not be much business left for inflight connectivity (IFC) companies to win.

However, many of the aircraft now claimed by SpaceX were already connected. What we are seeing right now is primarily a huge boom in upgrades as airlines transition from GEO-powered connectivity to LEO and multi-orbit services.

Ultimately, the global connected fleet has risen relatively slowly over the years and sits at just below 12,000 commercial aircraft – less than half of the active commercial fleet. So, what about the thousands of aircraft that are still unconnected?

It is worth stating that vendors have continued to press the case for IFC to this portion of the market, but it has proven difficult to convince carriers of the business case. Given current trends, though, the expectation is for service providers to renew their efforts to convince parts of the unconnected fleet to install IFC.

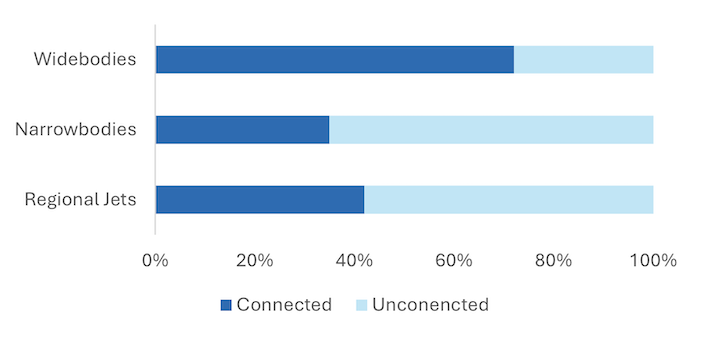

In terms of profile, Valour Consultancy’s IFEC data shows that narrowbody aircraft make up a huge slice of the addressable market, with approximately 64% of single-aisle jets still without IFC, versus just 25% of widebodies.

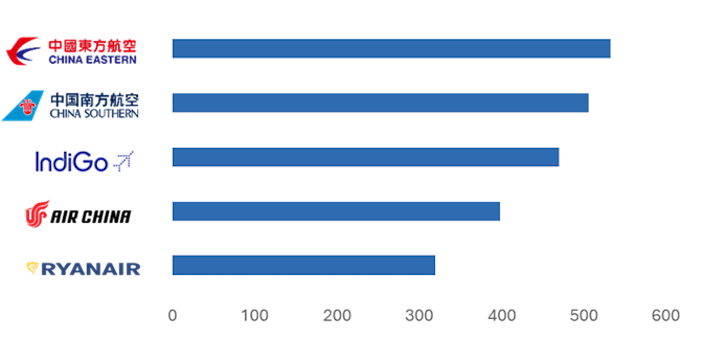

LCCs are also well represented in this segment, and we know how they typically feel about the economics of IFC. The recent public debate between Ryanair’s Michael O’Leary and SpaceX’s Elon Musk highlighted the tension clearly – the additional weight of IFC hardware increases fuel consumption and the cost of data is too high, making it hard to generate a positive ROI.

There’s reason to be optimistic about this sentiment changing. After all, passengers now expect connectivity to be available everywhere, and the commercial rationale for IFC is steadily improving through declining data costs, maturing commercial models (as evidenced by increased involvement of partner-led sponsorship models), and the availability of lightweight, low-profile, easy-to-install hardware. Together, these factors are gradually lowering the barriers to adoption.

From a geographic location perspective, the chart above, which shows the largest fleets of unconnected airlines in the world, hints at where a significant proportion of addressable market sits geographically. China accounts for more than 4,400 commercial aircraft, yet only around 10% of them are currently connected.

While the market presents regulatory and partnership complexities for Western vendors, recent developments – including China Southern selecting SES’s IFC solution for its new A350s, and Spacesail’s launch of its ‘Thousand Sails’ LEO network – indicate that momentum is building. Beyond China, a staggering 60% of aircraft registered to carriers in the Asia Pacific region remain unconnected.

Ultimately, while vendors compete intensely over the existing base of roughly 12,000 connected aircraft, a large opportunity lies in bringing connectivity to the unconnected majority. Narrowbody fleets, LCC operators, China, and India together represent one of the most substantial remaining addressable markets in commercial aviation.

Whilst we’re now beyond the low-hanging fruit for IFEC vendors, the latest generation of IFC services yields the best opportunity yet to connect the unconnected.

For companies seeking to go beyond the number of aircraft under contract for IFC and assess where the opportunity lies amongst the commercial fleet, Valour Consultancy’s Quarterly IFEC Market Tracker includes all the necessary information. Dating back to 2016, it offers a tail-level view of the global commercial fleet, created in partnership with Ch-aviation.

Using data obtained via a combination of primary and secondary research with many airlines and various other IFEC stakeholders, subscribers are able to quantify the true addressable market, assess penetration by segment and region, and identify where opportunity remains. Including splits by >1,000 airlines and almost 30,000 aircraft, deliverables are shared every three months, ensuring fluctuations in both the commercial and connected fleet are captured.