80% of airline passengers now consider inflight wi-fi access as being an essential part of the travel experience (according to a 2024 survey by Viasat). This is leading many airlines to shift from asking whether to provide inflight connectivity, to considering how to strategically deliver it.

In a new report by Moment, a provider of inflight entertainment, e-commerce and connectivity services for the travel industry, has found that connectivity is no longer an optional add-on, but a core element of the passenger experience. And one that must align with brand identity, fleet operations, and commercial ambitions.

The report, titled Inflight Connectivity Benchmark 2025, includes data-driven analysis of connectivity deployment, pricing structures, and satellite provider dynamics. The report features data from 106 airlines worldwide, covering connectivity deployment, pricing models, and technology suppliers across Europe, the Americas, Asia-Pacific and the Middle East & Africa.

Legacy carriers at the forefront

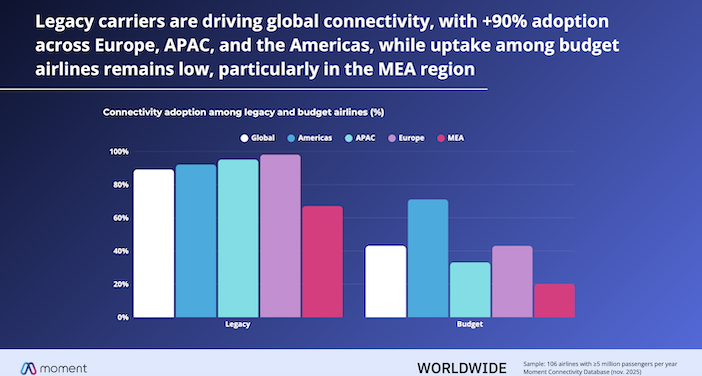

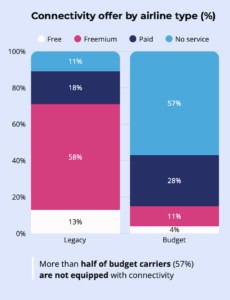

According to the report, 7 out of 10 airlines now provide inflight connectivity services, with adoption strongly driven by legacy carriers. Moment found that, depending on the airline business model, the approach to service tends to differ, with 89% of legacy airlines equipped with onboard wi-fi systems, while 57% of budget airlines are not.

Freemium models dominate

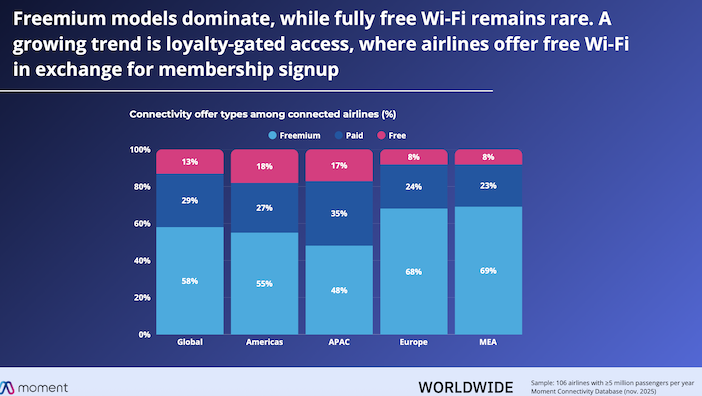

The report also highlights that ‘freemium’ access has become the most popular approach, adopted by 58% of connected airlines globally. The freemium model blends free basic services (typically messaging) with paid access for browsing or streaming, enabling airlines to balance passenger satisfaction with ancillary revenue opportunities.

Fully free-to-use wi-fi services are still rare (13% of global airlines), but they are growing rapidly as new LEO satellite providers improve affordability and performance. Several carriers are also offering free wi-fi access in exchange for joining their loyalty programmes.

Pricing strategy trends

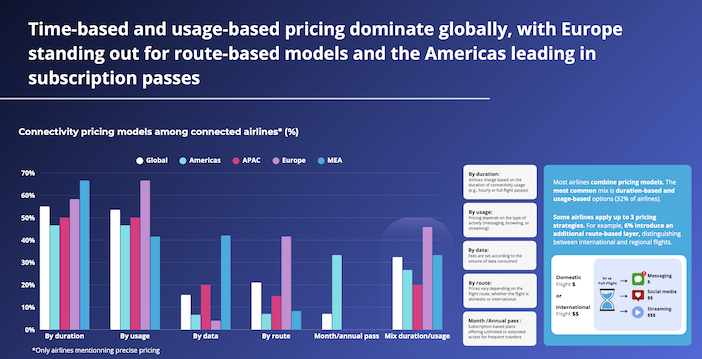

Moment’s analysis of pricing models shows that airlines are increasingly using a mix of several strategies based on duration-based pricing (55%), usage-based pricing (54%), with data-based and route-based models gaining traction and subscription-based models expanding, especially in the Americas.

Moment’s analysis of pricing models shows that airlines are increasingly using a mix of several strategies based on duration-based pricing (55%), usage-based pricing (54%), with data-based and route-based models gaining traction and subscription-based models expanding, especially in the Americas.

Entry-level access to services such as messaging remains affordable at an average US$ 3.73, while full-flight internet averages $19.70, allowing carriers to cater for both casual and more intensive users. The presence of monthly and annual passes signals a shift toward subscription-style connectivity, says Moment, reflecting the growing expectation of continuous digital access across journeys.

Regional dynamics

The report states that the global IFC landscape shows significant regional disparities, with the Americas and Asia-Pacific regions leading in maturity and adoption. The Americas stand out for a uniquely inclusive approach, as its budget carriers are the only airlines worldwide to offer free wi-fi access, while Asia-Pacific airlines are rapidly advancing, with 19% of carriers providing fully free access.

Almost all European legacy carriers have inflight connectivity and they are poised to improve their offer using emerging technologies. In contrast, finds the report, the Middle East & Africa remain in an early development phase, where limited deployment and wide gaps between carrier types highlight substantial room for growth.

“This evolving landscape signals a new era for aviation where inflight connectivity is becoming the backbone of a more intelligent, adaptable, and passenger-centric aviation ecosystem,” states Tanguy Morel, CEO of Moment.

“The industry has entered an era where connectivity must align with brand identity, fleet realities, and commercial ambitions. Airlines are no longer asking whether to offer wi-fi, they are defining what role connectivity plays in their service promise and revenue strategy.”